Caja Rural de Navarra

Institutional and Corporate Information

Caja Rural de Navarra

Registered name: CAJA RURAL DE NAVARRA, S. COOP. DE CREDITO

Legal Personality: Credit cooperative.

Corporate Purpose: To engage in all types of lending and deposit-taking operations and provide services typical of the financial institutions comprising the SPANISH FINANCIAL SYSTEM.

Registered Office: The registered office is in PAMPLONA at Plaza de los Fueros, 1.

Registration: Registered in the Register of Cooperatives and Limited Partnerships of the Directorate General for the Spanish Labour and Social Security Ministry with number 2163/344. S.M.T., in the Bank of Spain with number 3008 and the Navarra Companies Register with volume 11, page 175, sheet NA 183.

Tax identification number: F/31021611

Telephone: 948 16.81.00

Fax: 948 24.45.57

Corporate bodies:

Scope of operation: Caja Rural de Navarra's territorial scope of operation covers the whole of Spain, although the bank currently operates in the regions of Navarra, La Rioja, Guipuzcoa and Álava.

Main highlights:

Caja Rural de Navarra is a private socially responsible entity, a credit cooperative with more than 185,993 members whose available profit is used exclusively for two purposes:

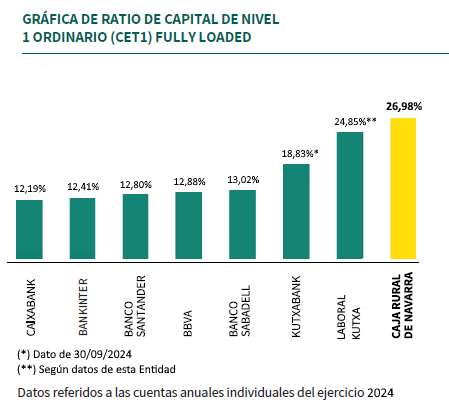

Because of its robust capitalization, Caja Rural de Navarra is one of the most solvent institutions in the Spanish financial system. Its fully loaded tier 1 capital ratio (CET1) in December 2024 stood at 26,98%, one of the highest in the Spanish financial sector.

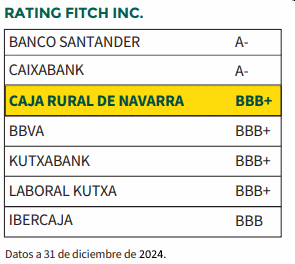

Caja Rural de Navarra is rated by two of the major global credit rating agencies: BBB+ by Fitch and Baa1 by Moody´s. This makes it one of the top-rated institutions in the Spanish financial sector.

Caja Rural de Navarra is part of the Caja Rural Group of financial institutions.This Group is inspired by the European cooperative model and affords the Bank complete management independence while allowing it to access the services and economies of scale of major financial group.

The Caja Rural Group is active throughout Spain and includes more than 2.346 branches, 9.296 employees, 3.096 ATMs, 6,3 million customers and 1,5 million members. Its main specialist subsidiaries are Banco Cooperativo, Rural Servicios Informáticos and Seguros RGA.

Profit for the year €236 million

Loans and advances to customers €9.387 million

Customers 682.500

Funds from private sector customers €12.849 million

Contribution to Social Welfare Fund €25,7 million

A financial group that was set up on 31 July 1990, mainly to act as central bank for the Cajas Rurales.

This company was founded in 1986 by a small number of Cajas Rurales, which were the first to adopt the now widespread use of outsourcing, pooling together their investment capacity to create a common, central data management centre aimed at unifying their operational support and achieving cost savings through economies of scale.

This is the insurance company for the Cajas Rurales. It comprises four companies offering the banks' customers insurance and pension funds. These are: Seguros Generales Rural, S.A, Rural Vida, S.A, Rural Pensiones, S.A. and RGA Broker Correduría de Seguros, S.A.